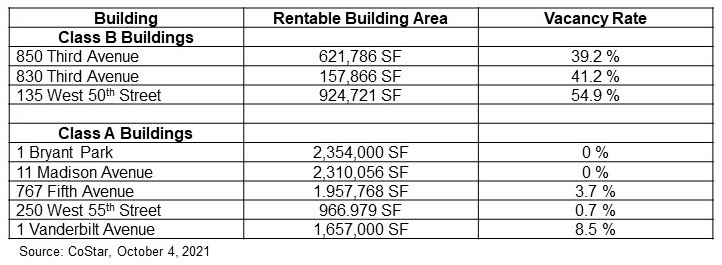

How has the pandemic affected the different sectors of the NYC office market? As you may note from the below grid, there is a widening gulf between the top-class A buildings and lesser performing class B buildings.

How has the pandemic affected the different sectors of the NYC office market? As you may note from the below grid, there is a widening gulf between the top-class A buildings and lesser performing class B buildings.

The class A buildings are unique because they have great views, they are near parks, they are either new construction or recently renovated – in sum, they are the top of the line in the city. There is no shortage of tenants for these buildings as many of New York‘s service and

technology firms have thrived during the pandemic, and therefore need spare no expense for trophy office space, which also functions as a draw for employees in a very competitive market.

In contrast, the class B buildings are somewhat drab 1970s style construction. They are perfectly serviceable pleasant workplaces but the views are pedestrian and the locations are not immediately next to Green space (such as 3rd Avenue). Further, these buildings face ferocious competition from the sublet market where rents are discounted in the range of 25 to 50%. For example, a tenant can now take space in a class A building on a sublet for the same price that used to be the market for class B buildings. Compounding the problem, due to supply chain disruptions the work required to build to the specifications of new tenants in the older buildings has become more expensive and difficult to perform.

In addition, while I provided three larger buildings as examples, other smaller class B buildings are in even greater difficulty because they are on side streets, they may be in less desirable areas (such as the west 30s), and they may only have one or two elevators, all of which put them at a competitive disadvantage when the demand for office space is shrinking due to remote work. Historically, the class B buildings always had to compete with the sublet market for their tenants. However, now the sublet market is larger than ever with a huge increase in the amount of space available.

When the tragic Covid period ends (hopefully soon) the stark reality of which landlords will no longer have a seat at this urban contest of musical chairs will become clear. It will be the owners of class B buildings, who have less resources than their larger counterparts, who will be left out in the cold. Many of these buildings will have to be re-purposed for other uses, such as residential, health care or education. The good news is that all of these uses are in great demand in New York.

Accordingly, not all is gloom and doom. While we see a secular bear market ahead for rent, this is good for tenants who can now take sublets in class A buildings at bargain rates. Office tenants will have a significantly expanded choice of higher quality offices at reasonable prices than ever before. That in turn will be a boon to the bottom line as they will be able to achieve savings on what is often the second or third largest item of expense of the company. Further, if some of the buildings are repurposed this may be a salutary development as all cities need to change and evolve to adapt to current needs. More apartments to meet rising demand, additional healthcare facilities and additional schools will be good for the community.

The bottom line is that we can expect considerable turbulence in the next 5 to 10 years in the New York City commercial real estate market, with winners and losers as detailed above. Whether this is considered good or bad depends on who’s ox is being gored.

Thank you,

Ruth Colp-Haber